-

Acquisitions

Profitable growth through acquisitions

Acquisitions form an essential part of our growth strategy. Each new company brings a unique perspective and technological expertise, strengthening our combined offering. By preserving our entrepreneurial spirit and investing in long-term development, we create the conditions for both growth and innovation.

Our acquisition model focuses on identifying and nurturing businesses with strong momentum, unique technologies, and innovative ideas. By integrating these into our business units, we ensure the continued success of both the individual companies and the Group. Collaboration between the Group's entities creates business opportunities that strengthen the business as a whole and increase our ability to achieve our vision of being a

market leader in sustainable business.

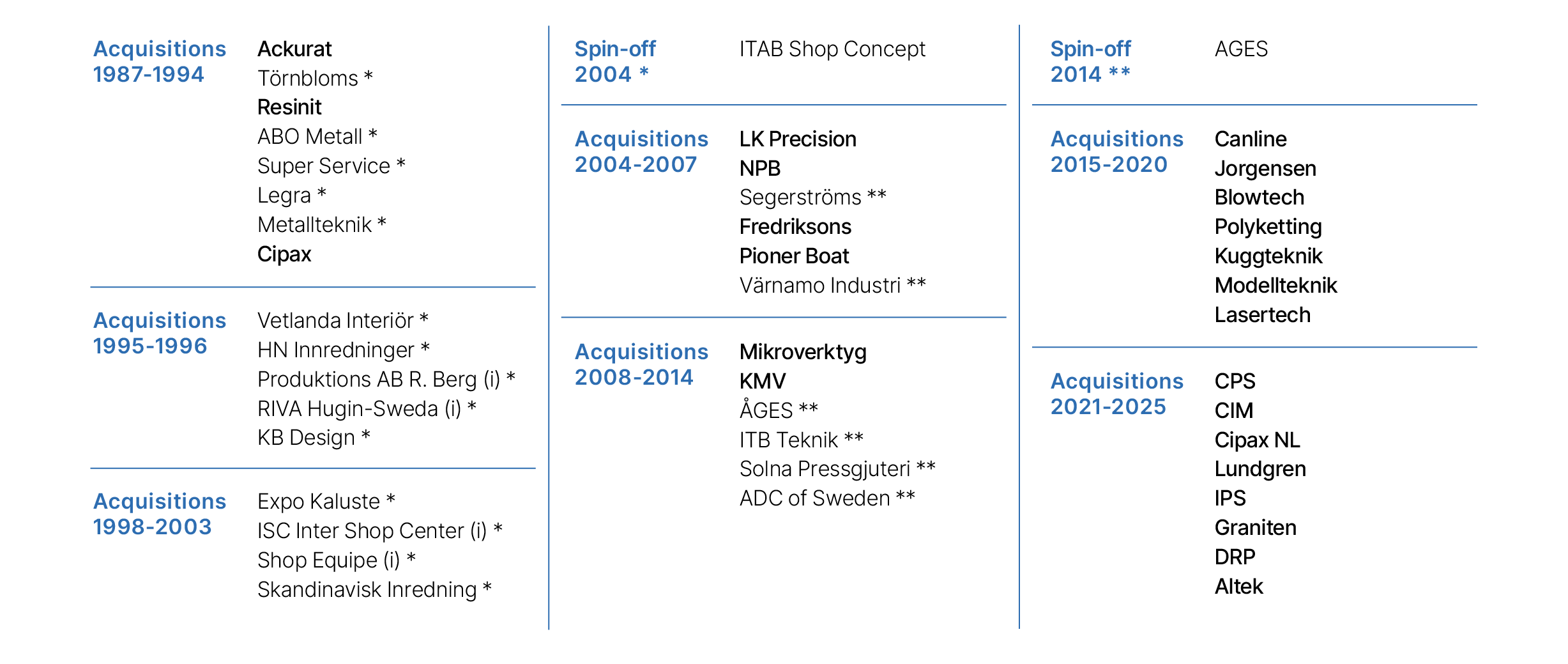

Since the 1980s, close to 70 companies and businesses have been acquired, which complement, add technical expertise or provide access to new market segments.

In order to streamline the business, provide further scope for larger units to develop and also create added value for the shareholders, two operations have been spun off: ITAB Shop Concept in 2004 and AGES in 2014, now listed separately on Nasdaq Stockholm and First North respectively.

Acquisitions and spin-offs

The image below shows entities that have been acquired until the end of December 2024 and either remain part of the XANO Group, or have been included in a spin-off and dividend to XANO’s shareholders. (i) indicates the acquisition of assets and liabilities (part of a company).

Companies/operations that were part of the ITAB Shop Concept spin-off are indicated with * and those that were part of the AGES spin-off are indicated with **.

In addition to those mentioned below, other businesses have been acquired and since been merged with Group companies, sold or liquidated.

XANO's acquisition model

Potential acquisitions are assessed based on how well they align with XANO's values and their potential to add business opportunities in one or more strategic areas: complementary offerings, geographical expansion and sustainable businesses.

A third crucial aspect in the evaluation of potential acquisitions is how the operations fit into the intended business unit and can contribute to its long-term value creation.

The Group's latest addition, Dansk Rotations Plastic (DRP), which has been part of the Industrial Products business unit since April 2024, adds valuable expertise and capacity in the production of polymeric materials. Its own product range complements our current one, and its sister companies are given access to new markets where DRP is a market leader. With its focus on recycled and bio-based plastic materials, DRP is also an important resource to strengthen the business unit's innovation power and ability to meet future material challenges.

DRP – rotomoulder with a strong sustainability profile

With over 50 years of experience in rotational moulding, DRP has a solid understanding of both specific customer demands and market requirements. With a focus on recycled plastics and bio-based materials, DRP offers solutions that help customers reduce their carbon footprints. This is particularly significant for the many industries where customers today demand solutions that combine high standards of functionality with sustainability benefits. DRP was acquired during spring of 2024 and the company adds both capacity, additional expertise and geographical expansion to the Cipax Group within the Industrial Products business unit.

More about CipaxGraniten - sustainable business through modular solutions

During the first half of 2024, XANO acquired Graniten Engineering, a leading provider of high-tech automation solutions for customers primarily within pharmaceuticals and medtech across Europe. Based in Sweden, Graniten develops advanced systems that combine innovation and quality to meet a global industry’s growing demands for efficiency, traceability and sustainability.

More about GranitenIPS adds additional growth opportunities within service and aftermarket

As a part of Industrial Solutions since the acquisition in 2023, IPS contributes to the business unit's mission of delivering advanced automation solutions and services for the manufacturing industry. The company’s technical expertise and extensive experience in the can-making sector, expand the business unit’s capabilities, particularly in service, aftermarket, and training.

More about IPSLundgren Machinery complements the Industrial Solutions business unit

Lundgren Machinery was acquired in 2023 to complement the operations within Industrial Solutions by adding adjacent technical skills and introducing new market niches. The acquisition means that the business unit's area of expertise is further broadened, and that Lundgren Machinery is given access to resources providing enhanced opportunities to develop its unique strengths.

More about Lundgren Machinery